SCORE

CHECK

IRIS HALLMAN

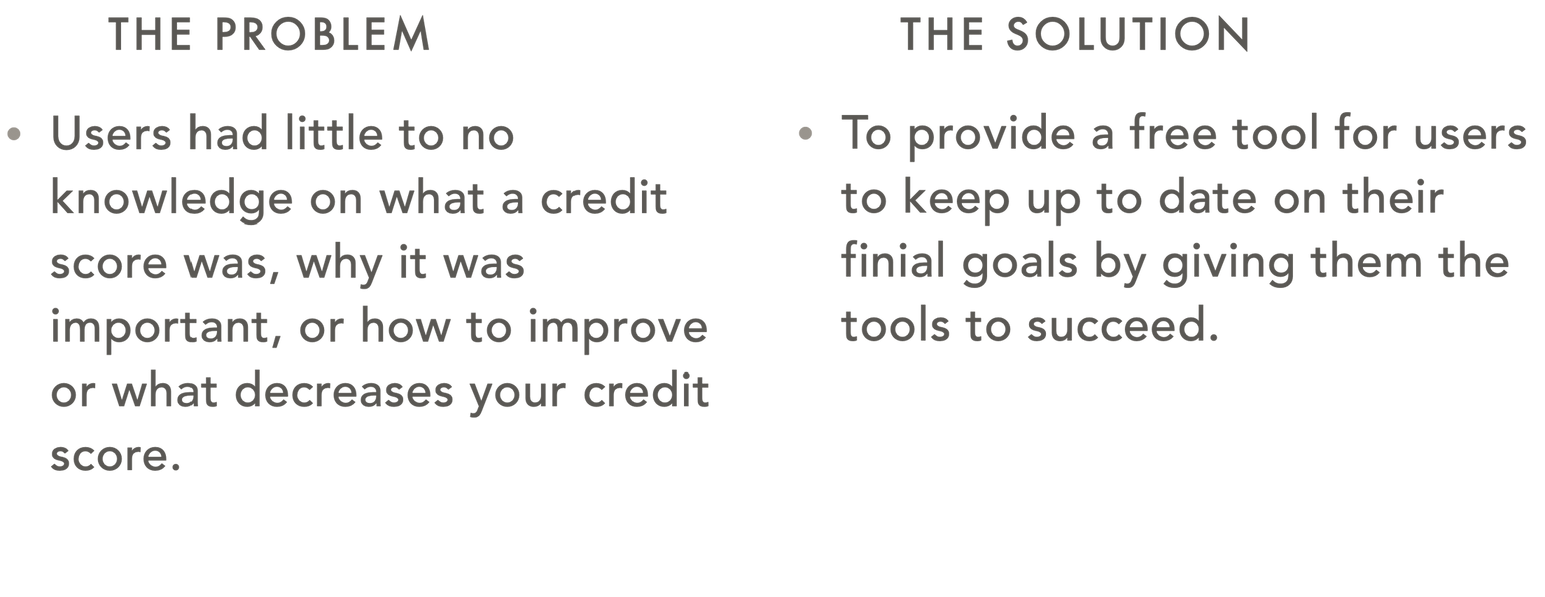

PROJECT OVERVIEW

UNDERSTANDING THE USER

USER RESEARCH

SUMMARY

i conductedboth primary and secondary research for the app.

Primary research included interviews with a variety of users ranging in age and demographic. What I had learned from these interview supported what I had thought: younger generations had very little understanding of what a credit score is or how to use it to their advantage.

While conducting secondary research my point was further proved. a majority of

people didnt know where to look for the information or even what to make of it.

USER RESEARCH

PAIN POINTS:

Information wasn’t accessible

lacked knowledge

Users were unsure of what a credit score was Or how it impacted their future.

Credit score is not easily accessible. therefore it can be hard more users to manage.

Lacked Education

After find out what their credit score was users still did not knowwhat affected their credit score or how to improve it.

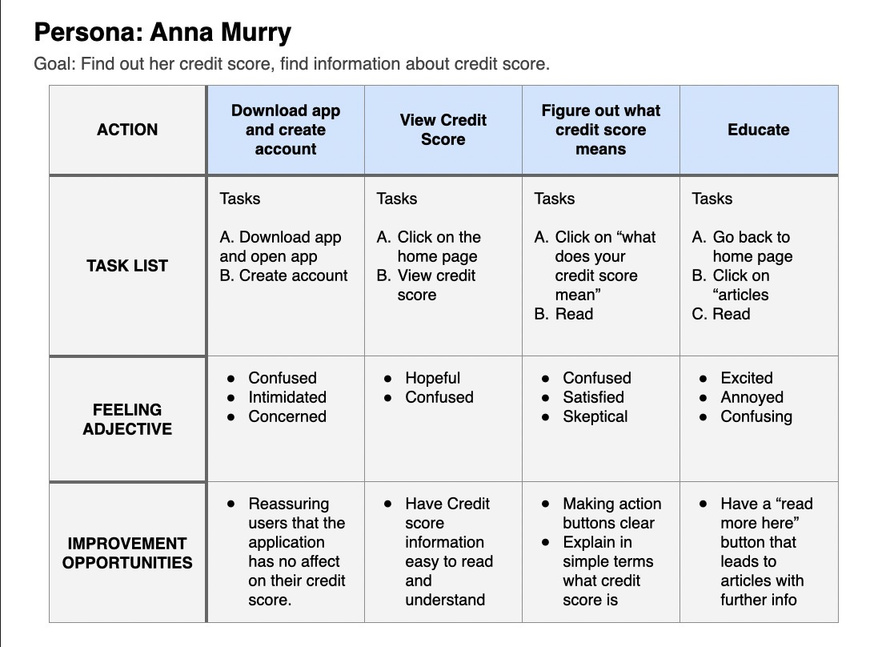

PERSONA:

Anna is a single 23 years old she will be graduating form university in the fall and is excited to start her career as a graphic designer.

Anna’s wants include owning a home, buying her first car and collecting passive income through investments

Her frustrations include student debt, and how challenging it is to get a hold of her credit score and information.

Anna Murry

Graphic Designer

Mike Montminy

Buisness Owner

PERSONAS

Mike is a marred 30 year old who owns a small carpentery buisness. Mike graduated from college 5 years ago.

Mikes needs include: expanding his business, paying off the last of his student debt and wedding loans

Mikes frustrations include:

Figuring out why his credit score decreases even though he's paying it back on time.

USER JOURNEY MAP

The app allows user to check their score as well as information about their score and the resources to educate themselves on how to improve it.

STARTING THE DESIGN

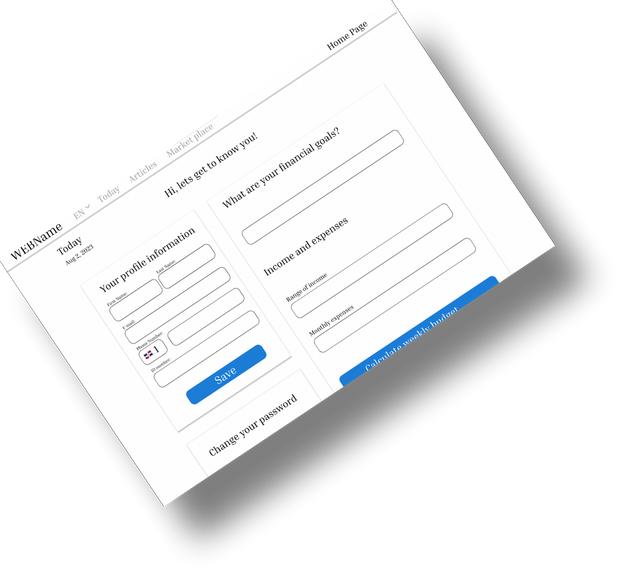

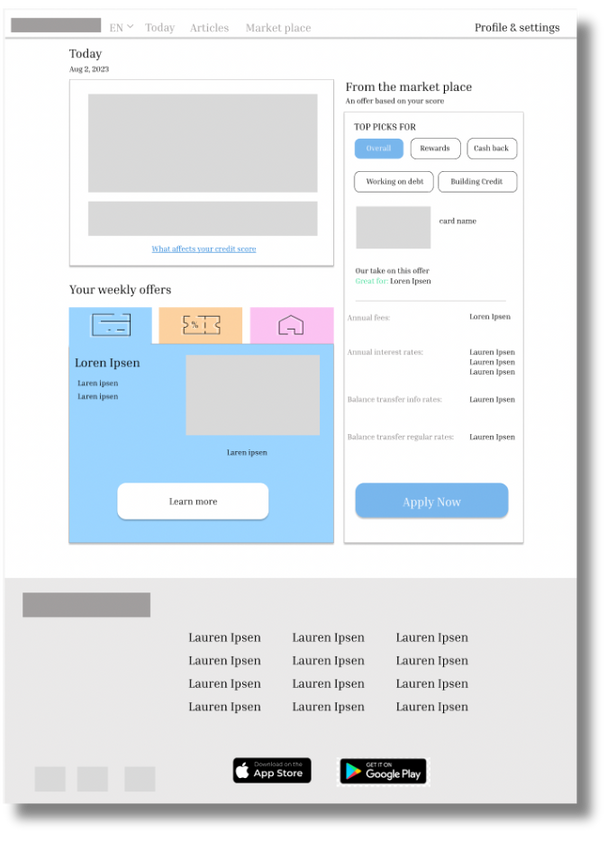

DIGITAL WIREFRAME

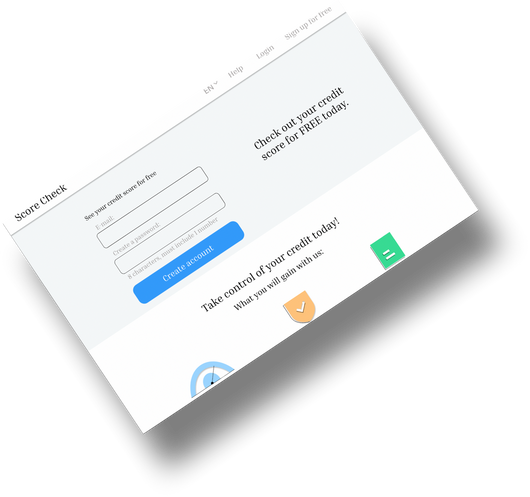

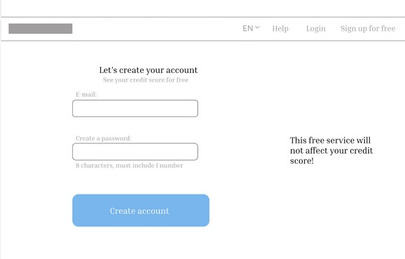

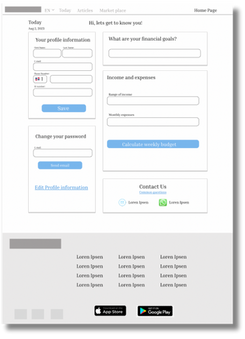

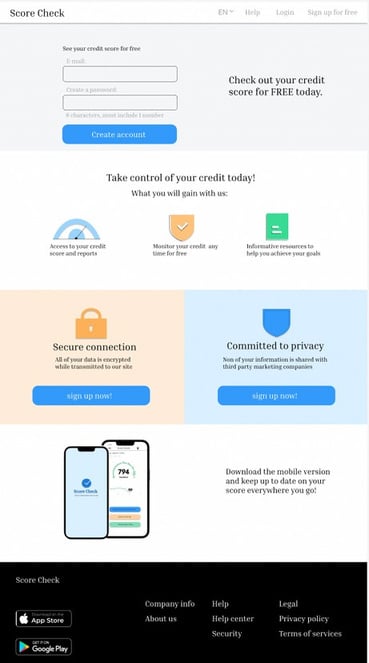

The goal for this design was to be as clear as possible. Information is clearly grouped and sorted based off of priority.

DIGITAL WIREFRAM

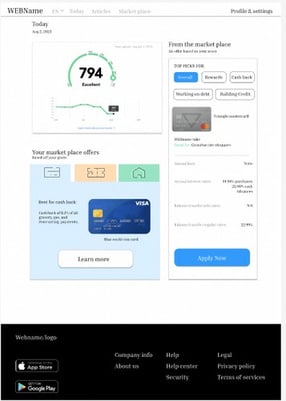

Area for Credit score right on the front page.

expert insight specifically offered for each individual user.

With a quick access link for more information

HOMEPAGE

specific recommendations based off of users goals and score.

Try out the prototype here

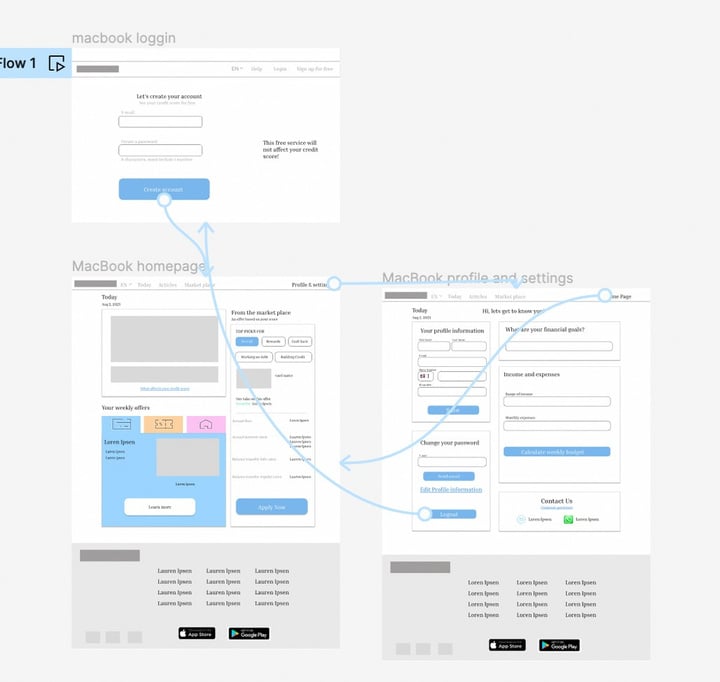

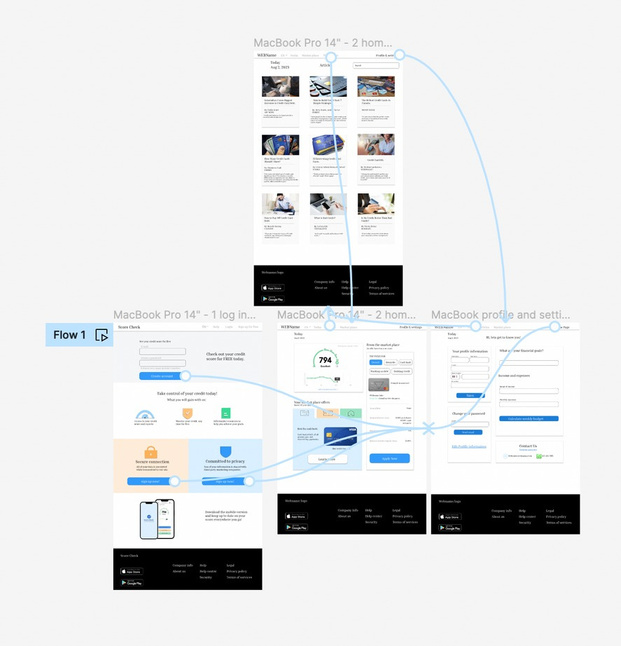

LOW-FIDELITY PROTOTYPE

The Low fidelity prototype shows how easy it is to navigate the website regardless of the users needs.

There are clear action buttons and indicators for what ever path the user wishes to take.

ROUND ONE FINDINGS

The colors selected were too light. There was not enough contrast between the color and white background.

More information on the log in page was necessary to

assure users that the website was not going to affect

their credit score

USABILITY STUDY: FINDINGS

I learned alot from the study. I took these findings and created solutions to help make the design more accessable

ROUND TWO FINDINGS

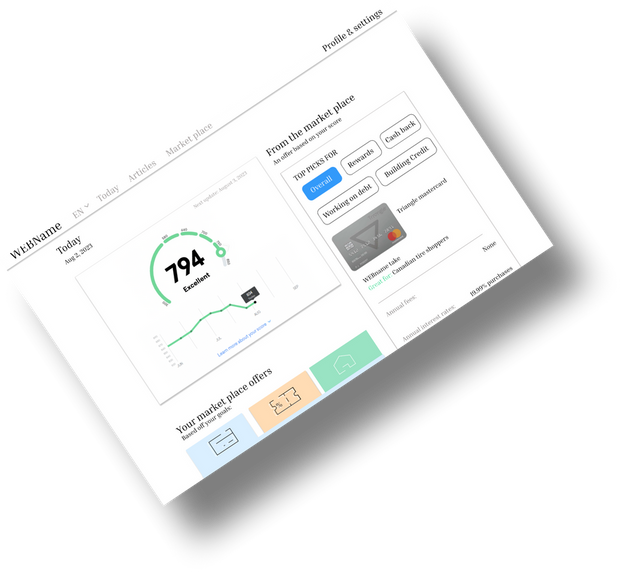

the article page needs a search bar and category columns to better organize information

A more condenced mobile version that isn’t so overwhelming

REFINING THE DESIGN

MOCKUPS

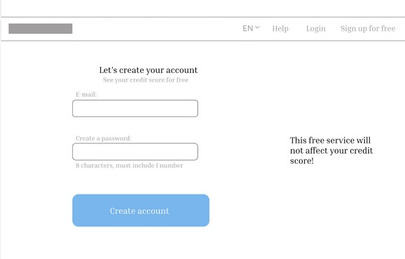

The login page was expanded and more information was added about the website to help reassure users

BEFORE USABILITY STUDY

AFTER USABILITY STUDY

colours were darkened

to make the colour scheme more accessible

A reference bar was also added.

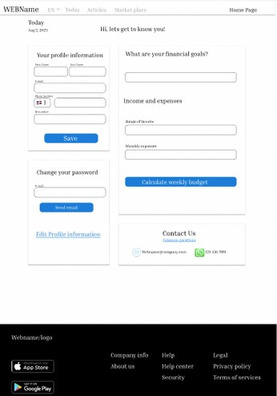

MOCKUP

Log in

homepage

settings

articles

High- Fidelity prototype here

HIGH-FIDELITY PROTYPE

The High-fidelity prototype meets the needs of the users better with being functional and aesthetically pleasing with the seconds usability study conducted on high-fidelity prototype, the design reached its final form and ready to launch.

ACCESSIBILITY CONSIDERATION

01

02

Color palette was check, and changed.

text style and size were considered for accessibility

03

Icons were grouped with text for screen readers

GOING FORWARD

Take aways

Next steps

TAKEAWAY

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

WHAT I LEARNED

Through this process I’ve learned the importantce of interviews and insights. I had a general Idea to get credit scores to people but didn’t realize there was more information necessary with that.

I also learned the importance of color and informational hierarchy.

IMPACT

“I’ve been saving up to get a car and was trying to get a lone but was refused becuase of my low credit score. I didnt realize it was low or how to fix it oreven what it was. And getting the information was so complicated”

“This app is a perfect way for me to keep up to date with my credit score and it makes me feel like I control it instead of it controling me”

NEXT STEPS

01

Create more specific column to group related articles in sections

02

improve design skills and tool knowledge

THANKS FOR YOUR TIME!

ghallman62442@gmail.com